What type of life policies requires a nonforfeiture provision? This question sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Nonforfeiture provisions play a crucial role in life insurance policies, safeguarding policyholders from financial losses and ensuring their continued coverage.

Join us as we delve into the intricacies of nonforfeiture provisions, exploring their purpose, types, calculation methods, and regulatory considerations.

Nonforfeiture provisions are legal requirements embedded within life insurance policies, designed to protect policyholders’ financial interests. These provisions guarantee that policyholders retain certain rights and benefits, even if they fail to make premium payments or surrender their policies prematurely. By providing a safety net, nonforfeiture provisions empower policyholders with peace of mind, knowing that their coverage remains intact during challenging times.

Nonforfeiture Provisions: Overview

Nonforfeiture provisions are legal requirements in life insurance policies that guarantee policyholders a certain level of protection against financial losses. These provisions ensure that policyholders can continue their coverage even if they stop paying premiums, or receive a cash value if they decide to cancel their policy.

Nonforfeiture provisions are regulated by state insurance laws and must meet specific requirements to ensure that policyholders are adequately protected.

Types of Nonforfeiture Options

There are several types of nonforfeiture options available to policyholders, including:

- Paid-up insurance: This option allows policyholders to maintain their coverage without paying any further premiums. The death benefit is reduced to the cash value of the policy.

- Extended term insurance: This option allows policyholders to continue their coverage for a limited period of time without paying any further premiums. The death benefit is equal to the face amount of the policy.

- Reduced paid-up insurance: This option allows policyholders to maintain their coverage for a reduced amount without paying any further premiums. The death benefit is reduced to a percentage of the face amount of the policy.

Calculating Nonforfeiture Values

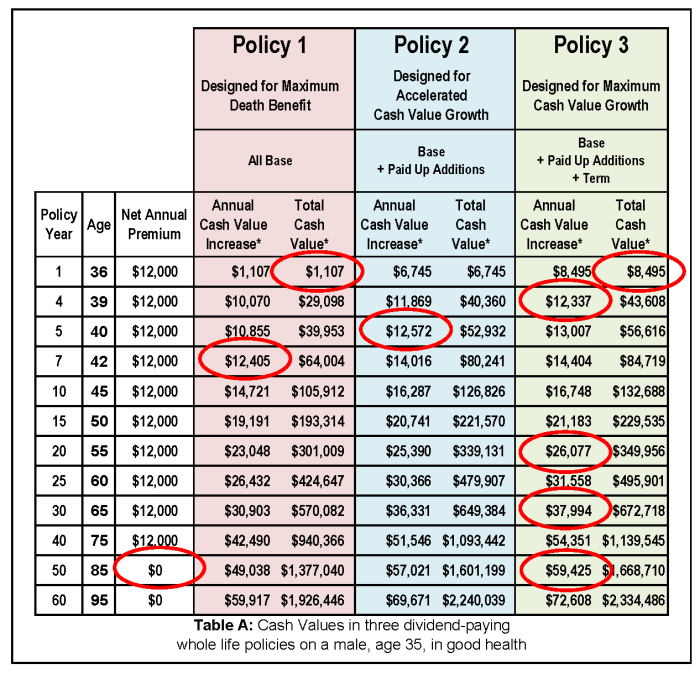

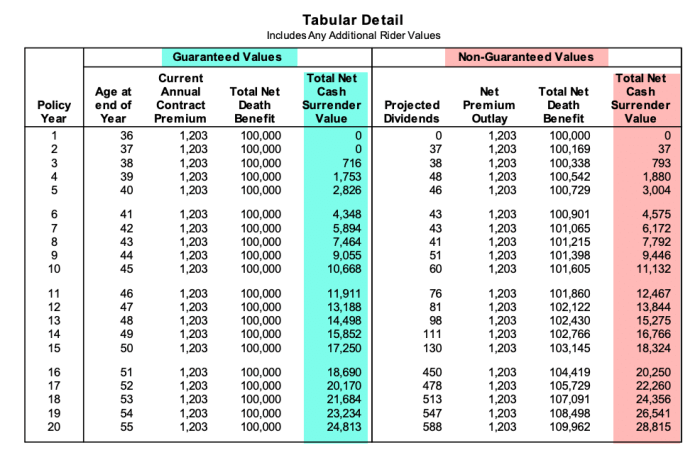

The nonforfeiture value of a life insurance policy is the amount of cash value that the policyholder is entitled to if they stop paying premiums or cancel their policy. The nonforfeiture value is calculated using a formula that takes into account the policy type, premium payments, and interest rates.

The following is a step-by-step guide to calculating the nonforfeiture value of a life insurance policy:

- Determine the policy type.

- Calculate the cash value of the policy.

- Apply the nonforfeiture factor to the cash value.

- The result is the nonforfeiture value.

Impact on Policyholders

Nonforfeiture provisions have a significant impact on policyholders by providing them with financial protection. These provisions ensure that policyholders can continue their coverage even if they experience financial difficulties or decide to cancel their policy.

Nonforfeiture provisions have also been shown to increase the value of life insurance policies by providing policyholders with a cash value that they can access if needed.

Regulatory Considerations, What type of life policies requires a nonforfeiture provision

Nonforfeiture provisions are regulated by state insurance laws to ensure that policyholders are adequately protected. These laws require insurance companies to provide policyholders with clear and concise information about nonforfeiture options and to calculate nonforfeiture values in a fair and equitable manner.

Insurance regulators also have the authority to investigate complaints about nonforfeiture provisions and to take enforcement action against insurance companies that violate the law.

Query Resolution: What Type Of Life Policies Requires A Nonforfeiture Provision

What is the purpose of a nonforfeiture provision?

Nonforfeiture provisions protect policyholders from losing their coverage if they fail to make premium payments or surrender their policies prematurely.

What types of nonforfeiture options are available?

Common nonforfeiture options include cash surrender value, paid-up insurance, and extended term insurance.

How are nonforfeiture values calculated?

Nonforfeiture values are calculated based on factors such as policy type, premium payments, and interest rates.

What are the regulatory considerations surrounding nonforfeiture provisions?

Regulatory agencies oversee nonforfeiture provisions to ensure that policyholders are adequately protected.